I have always felt very uncomfortable with debt, and for that discomfort, I am thankful. It’s such a drag to feel like you are always trying to play catch up. It is disheartening to make money, only to sink it into purchases from the past. Worst of all, it is an unsettled feeling of despair that sets in so deep to your subconscious that you don’t even realize how it has affected your everyday life, until it is finally paid off in full. When you finally become debt-free, there is such a calming peaceful feeling. It was so much determination, blood (literally), sweat and tears to reach my debt-free goal, but now I am a year debt free, and it was so WORTH IT!

At the beginning of 2019 I started off the year with a clear goal: Pay off my debt in full! My debt was equal to about 25% of my annual income. I was single, and let me be clear, I did not receive any money from my boyfriend or anyone else. My job was a Starbucks barista. Can you imagine making about 19K a year feeling so worried about the debt you owe, and the money you are not making? Maybe you can imagine that easily? I got out of debt, and have stayed out of debt, and you can too.

I used the Dave Ramsey Baby Steps Plan as the blueprint to achieve my goal. Dave Ramsey is a radio host, author and businessman who makes it his life’s work to help people who are in debt, have the encouragement and sound guidance to achieve financial peace.

So how does the Dave Ramsey plan work? It is pretty straightforward. There are 7 steps, and if you are determined to stick to it, you will succeed like thousands of others have over the years.

The 7 Baby Steps

Baby Step #1 – You need to save $1000 in the bank, to create and emergency fund.

This is for when life throws you unexpected emergencies. Rather than putting the expense on a credit card, you have this fund to dip into.

Baby Step #2- Pay Off All of your Debt (except your house) using the Debt Snowball

List out all of your debts from smallest to largest, and pay them off in that order. The motivation that comes from paying off the small ones first, rolls into the larger debts. Stay focused, and pay them all off.

Baby Step #3 Save up 3-6 Months Worth of Expenses in a Fully Funded Emergency Fund

You finally paid off your debt! At this stage you can slow down a bit, and work on saving up for future emergencies (such as this Covid 19 shut down we are currently in, or a job loss, or sudden life change.)

Baby Step #4 Invest 15% of your Total Household Income in Retirement

Baby Step #5 If you Have Children, this is the Step to Save for their College Fund

Baby Step #6 Pay off your Home Early

Baby Step #7 Build Wealth and Give

To read more about these baby steps, you can click here.

At the time that I was going through my debt free journey, I was working as a barista at Starbucks, and one of the lovely perks of that job was a free Spotify account. I would download Dave Ramsey’s podcasts, and every day I’d go on a long walk listening to it for motivation. I loved hearing the people call into the show to talk about their debt free journey, how they sacrificed to pay their debt off, and they would conclude the call with a loud debt free scream. You would hear calls from all different types of income levels. I made less than 20k and paid my debt off. I believe anyone dedicated enough can achieve this goal. It is not easy, and it takes HUGE sacrifice and determination, and probably a long time, but it is totally possible.

Here are 14 points I personally implemented to achieve my debt-free goal.

1.) I created a STRICT budget and stuck to it. I put cash into envelopes for most of the budget categories, and once that cash was gone, that was it. (more on that here )

2.) I shopped at Aldi, and made $20 worth of groceries last 2 weeks. Mainly rice, beans, PB&J, and eggs.

3.) No internet at my home, I used the library and coffee shops.

4.) Also no subscriptions or services related to entertainment (ex. cable, Netflix, etc). I watched the free TV stations, and borrowed dvds from the library if I wanted something to watch. ( My favorite library TV series check outs being Homeland, Mr. Selfridge, and The Crown).

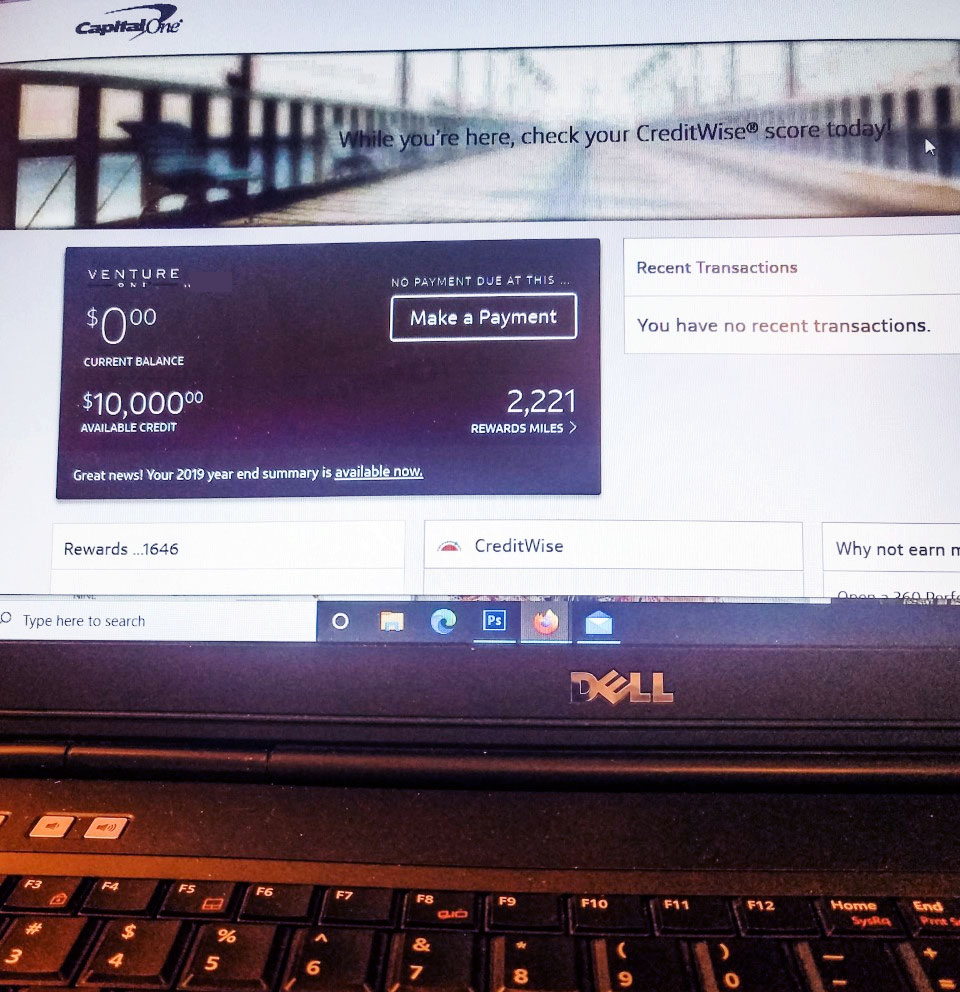

5.) During this time I used 2 cell phone services, both with a refurbished phone from Swappa. First I used a service called Ting, and then I switched to Pure Talk USA. I still use Pure Talk USA now, I like it because it is only $21.13 a month. I feel like this is probably my best tip for saving money.

6.) I drove, and still drive a “cash car”. What I mean by that is I bought a nice, well researched used car, instead of having a “debt car” with car payments. I had $3000 cash in my hand and offered it in exchange for a car that was priced $3700, and they accepted. This car is a 2008 Hyundai Elantra. It currently has 186K miles on it and going strong. I have not had any major problems with it, just oil changes and new brakes. It may not be the most fancy car, but it sure has been a financial blessing in my debt free journey.

7.) I picked up extra shifts at Starbucks

8.) I temporarily stopped contributing to my 401K until my debt was paid off, and I used that cash that would have gone into the 401K, to pay off the debt asap.

9.) I took an extra job in the late afternoon/ evenings unpacking and creating floral displays at a grocery store.

10.) I sold my blood plasma twice a week for weeks until my debt was paid off.

11.) I started pet and plant sitting, and took on seamstress gigs when opportunities arrived.

12.) I sold my belongings that I could part with.

13.) I adopted a sense of minimalism, and genuinely enjoyed simple and inexpensive goods, like my $20 leather purse (instead of a designer purse). The desire to shop is difficult to smother, but it is necessary when paying off debt.

14.) I did not belong to a gym, only worked out outside.

I hope this post will encourage you with some ideas if you are in the situation I was. You are not alone, and you can do this! The most important key is to have an unyielding discipline with your eye on the prize. Sacrifice is worth it to get there.